NORBERTO C. NAZARENO

“PUEDE PALA”

It is NOT true that informal settlers do not have money. When they pooled their funds together, they could lend to themselves and generate an economic value that allowed the original pool of funds to grow. This is our local miracle of the “multiplication of bread and fish.” “Wala daw pera sa ‘areas’. Wala nga malakihan pera, pero noong pinagsama sama ang mga barya, malaki ang nalikom. At ng ito ay napaikot, at habang umiikot, lumalaki ang koop.” (They say they have no money in the ‘areas’. This may be true: there are no large amounts owned by any individual. But when all their savings were pooled together, they were able to raise a sizable amount which had a multiplier effect allowing the coop to grow.)

In the end, we gathered baskets full of remnants much more than what we needed to start and sustain a community Credit Cooperative.

Would you believe that our coop has no external borrowings? All funds come from capital and deposits of members who come mostly from the ‘areas”. We were not only able to meet the total borrowing demands of our members. We have been able to give substantial dividends and patronage refunds. We have been able to build hospitalization and community funds and many other funds. And, as an extra attractive bonus, the “samahan” (association) has successfully created a “damayan” (mutual help) fund which gives out P250,000 to the beneficiaries of deceased members.

BY ITS FRUITS

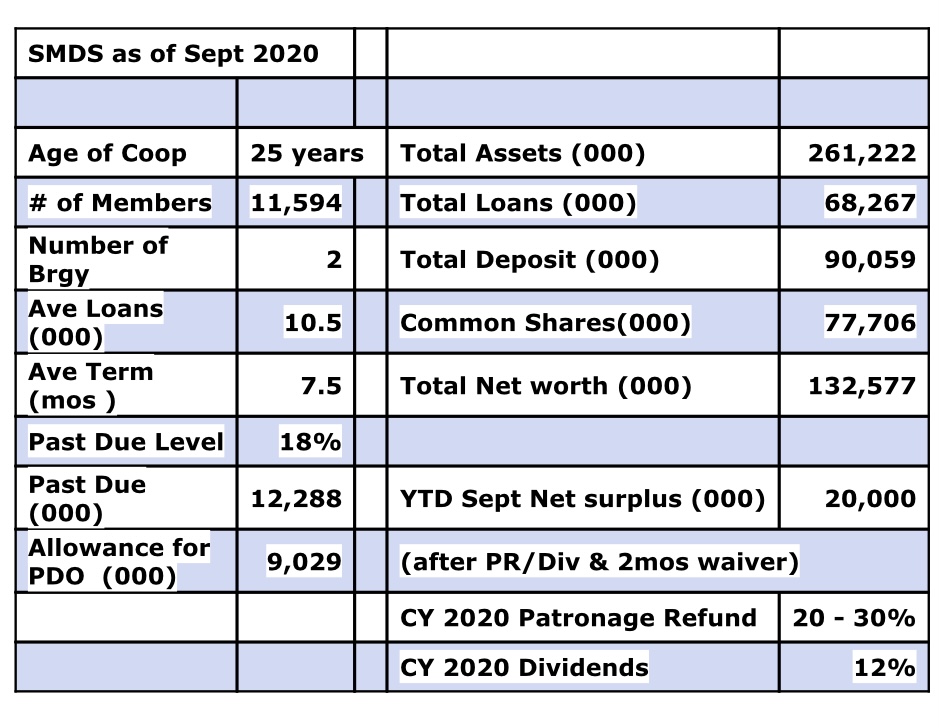

Our credit coop, Sta. Maria della Strada (SMDS) Multipurpose Cooperative, is celebrating its 25th year of successful operations this year. It is financially in solid footings notwithstanding the economic backlash of Covid 19. From an initial 15 cooperating members with a capital base of just P30,000.00 in 1995, it has grown to about 11,500 cooperators with a capital base of P77.7 Million as of September 2020. It operates only within a 2 kilometer radius covering two barangays: Loyola Heights and Pansol, QC. Even a small area like this can generate substantial volume to maintain professional management the same way a branch of a large bank would. Pre pandemic, it lends about P1 million per day! Truly microfinance as the average loan is P10,700 and the average term is 7.5 months. And, believe it or not, it has yearly been able to declare at least 20% dividends and returned Patronage Refund of at least 20% to borrowing members. It is the Lord!

WAITING TO BE ORGANIZED:

As our coop was growing, we realized that many were just waiting for a group like us to organize and professionally manage a credit cooperative as a business. “Pagpapautang” is the normal “credit card system” in the areas. There are borrowing demands for working capital for productive use. Some find the need because of a mismatched cash flow to meet their daily requirements. One of our stated mission is to compete with 5 – 6’s and provide alternative longer-term funding at more reasonable rates… from a professionally run business institution… a business which they also own.

DOUBTS AND ANXIETIES

Some of us in the core group were very skeptical when we started. How can a savings and credit cooperative thrive in low-income areas? They are first “isang kahig, sang tuka”. They have nothing to save. And second, their credit risks are as poor. They concluded: “we’ll just end up doling out money”, as we have done in many non-sustainable economic and livelihood projects we have undertaken. We accepted this fact. If it ended up a disaster then it will be a dole out, but on a controlled basis, and a manageable amount. After all, did we not end up donating time, talent and money to the community many times in the past? This was going to be just another form but this time we deliberately added important ingredients: part-time committed volunteers: our managerial skills, our banking and lending experience, our God-given talents. We committed our time and efforts to oversee and intelligently assess if the program was sustainable on the ground.

Things fell into their proper places. We planted the seed. The stalks grew. The leaves sprouted. Sta. Maria della Strada helped. Finally, the Lord made it grow to bear much fruits. Patience was key. We believed even then that all things were possible with the Lord.

2020 VISION

Hindsight always gives a clear vision. We hope that others too can take the first step, spend their time, use their God-given talents, and take up the courage to start a similar activity in their communities. We confirm it works… and is helping many in Barangay Loyola Heights and Pansol, Quezon City. Come and see. We are more than willing to share our mistakes upon which we have been able to build our successful coop.

THE NUMBERS SPEAK… for themselves

TIP OF ICEBERG OF FRESHWATER

This brief article is the tip of a “life-giving iceberg of freshwater” for many of our brothers and sisters. It can be replicated in many other areas all over our country, especially among the urban informal settlers. WANTED: committed volunteers with their respective time and talents. We know there are many. Ateneo Class ’67 and the Rotary Club of Pasig, for example, have taken the initiative and have accepted the intricacies of running one.

The Credit Coop works! It can help many. It is helping 11,500 members at Sta. Maria della Strada Parish. Many similar parish-based organizations can multiply these numbers a hundredfold. The parish leaders of St. John the Baptist in Taytay have been running a successful credit coop patterned after SMDS the past 5 years. So is it with Our Lady of Fatima Parish in QC.

To assist others in starting, see Our Local Multiplication of Bread and Fish, The Story of a Credit Cooperative, Pananagutan – Link

https://www.whitebutterfly.ph/2020/12/01/our-local-multiplication-of-bread-fish/